The continue reading how to measure deferred tax when a company pays tax as per mat.

Deferred tax for mat calculation.

So deferred tax asset is created which is adjusted with the deferred tax liability of last year.

How to measure deferred tax when a company pays tax as per mat terms to be known.

There are controversies if deferred tax liability debited to p l should be added to the book income for the purpose of mat calculation.

3 09 000 will be shown as deferred tax asset under non current assets.

It is the tax effect of timing differences.

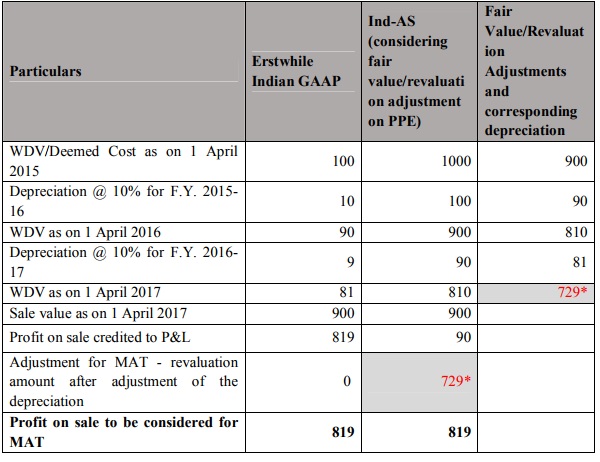

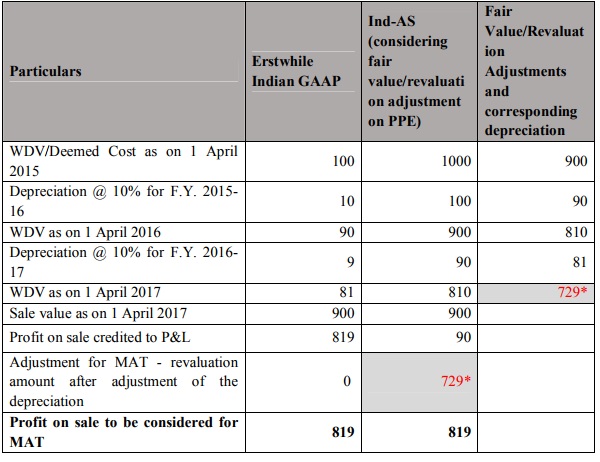

Section 115jb levies minimum alternate tax mat at 10 of book profits plus surcharge and cess thereon if such tax is higher than the tax payable under the normal provisions of the act.

The deferral comes from the difference in timing between when the tax is accrued and.

The treatment of deferred tax charge in determining the tax liability under the special provisions of section 115jb of the income tax act is one such case.

250000 and depreciation charged as per it act is rs.

Mat a brief introduction.

It is advised that for filing of returns the exact calculation may be made as per the provisions contained in the relevant acts rules etc.

It is the opposite of a deferred tax liability which represents income taxes owed.

450000 then accounting profit will differ from it profit.

Kolkata tribunal in balrampur chini s case has held that the deferred tax liability should not be added back whereas the chennai tribunal in prime textiles ltd case has held otherwise.

Here an effort is made to comprise all tax computation viz provision for tax mat deferred tax and allowance and disallowance of depreciation under companies act and income tax act in one single excel file.

If depreciation charged for the year as per companies act is rs.

In this article we will be discussing how to calculate deferred tax asset and liability that arises due to depreciation.

By computing differences in wdv as per it and companies act.

Minimum alternative tax is payable under the income tax act.

Deferred tax liability is a tax that is assessed or is due for the current period but has not yet been paid.

The balance of rs.

Disclaimer the above calculator is only to enable public to have a quick and an easy access to basic tax calculation and does not purport to give correct tax calculation in all circumstances.

A deferred tax asset is an item on the balance sheet that results from overpayment or advance payment of taxes.

Friends most of us face the challenge of calculating tax as per income tax and as 22.